Healthcare costs are a HUGE issue for most employers and especially those with tight margins.

If you have 50, 100 or 1000 employees on your medical plan the cost is likely your largest business expense after payroll. Unfortunately, the culture that surrounds the purchasing of healthcare is one that leans towards passivity. The 'it is what it is' mindset has been a major determinant driving poor outcomes for a long time.

Does the following scenario sound familiar:

Your insurance broker schedules the annual renewal meeting with HR to review a spreadsheet of insurance company options. The renewal increase is 8.7%. On the spreadsheet are various 'alternatives' with higher copays and deductibles that reduce the impact of the increase. There are also a few 'no increase' options from some other carriers. After a little back and forth the broker leverages the 'no increase' options and gets the incumbent carrier to lower the renewal to 4.9% (or even 2.9%). Everyone breaths a sigh of relief. Employees are asked to contribute a little more and so does your organization. Check the box for another year.

This is how it goes year after year...except for the year when premiums go up 25% or 30% and there is no safe harbor. Everybody tightens the belt that year for sure.

Sadly the belt is never loosened.

Millions and millions of hard earned dollars are spent each year through this process. A process which oftentimes receives less attention than purchasing the new coffee machine for the break room.

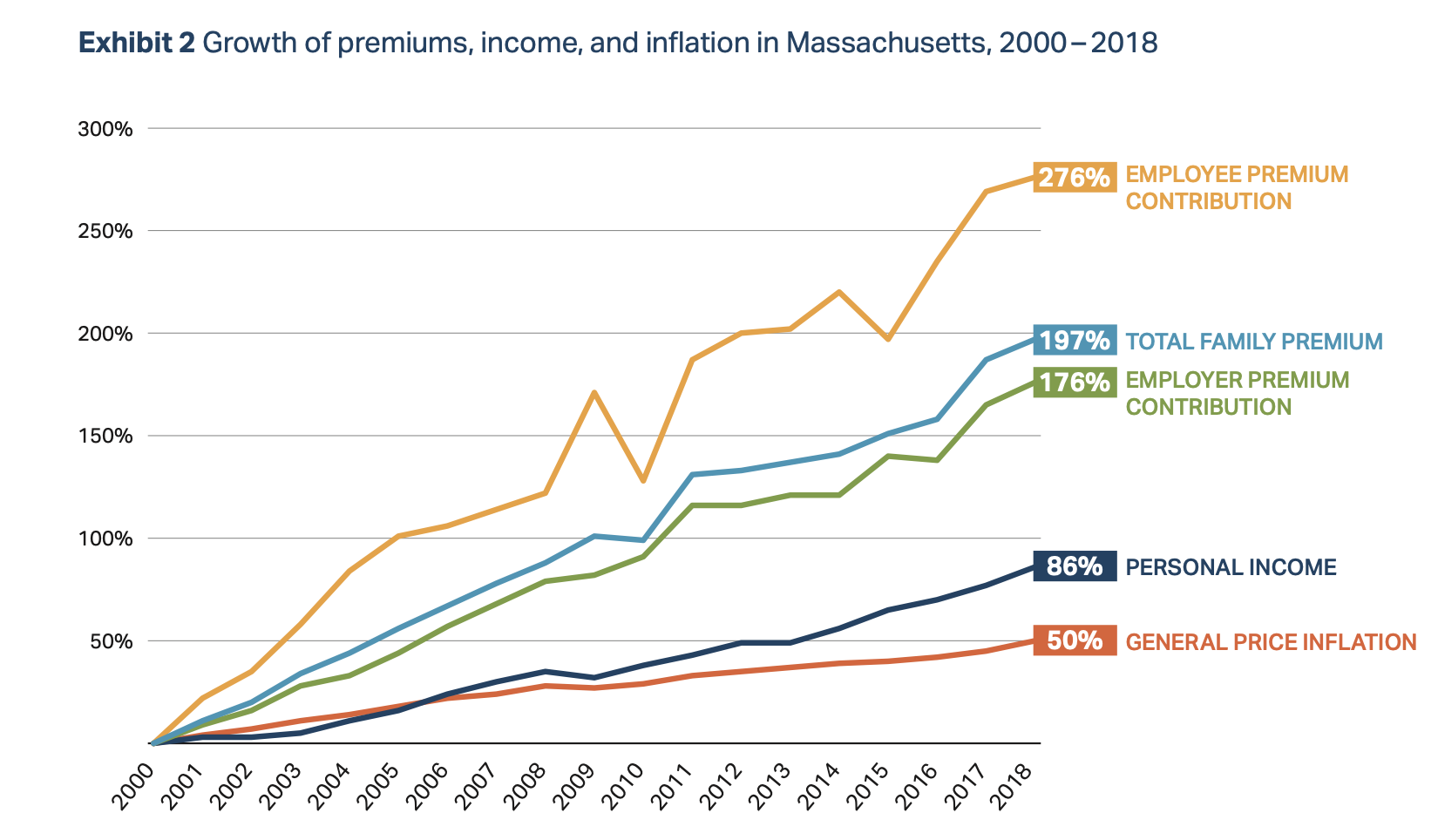

The problem is the insidious nature of health insurance increases and how they have significantly outpaced earnings. Healthcare costs are literally robbing employees (and their employers) of money that could go to things like food, shelter, clothing, transportation, education, retirement and even a well deserved vacation.

Fortunately it doesn't have to be that way. Employers can evolve from passively managing their healthcare plan to actively managing the program.

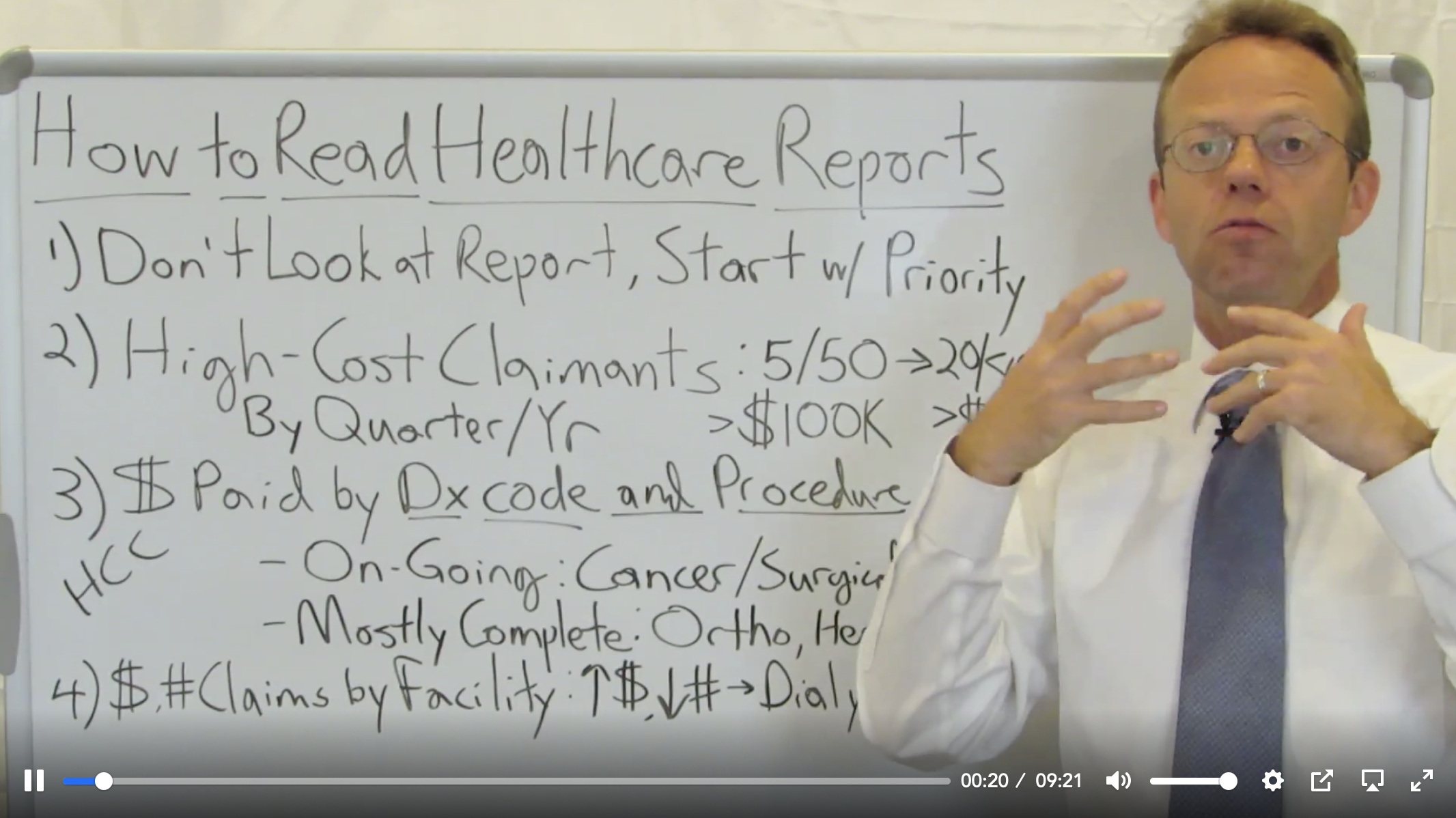

What's the first step? Watch this video of Dr. Eric Bricker discussing Healthcare Reports then ask yourself these three questions:

1. Is this the conversation I'm having with my insurance broker?

2. What insight do I have into my 'high cost' claimants and what track are they on?

3. Who is actively working on my behalf to drive employees to high quality low cost doctors and hospitals so costs are controlled? Who is actively managing the high cost claimants?

Active management is all about addressing these questions and taking action.

Your knee-jerk reaction might be to say to yourself - 'this is too hard' or 'I don't have the time.' The truth is learning anything new takes an investment of time and effort. We all know that getting better results often requires doing things a little differently. Fortunately there are many advisors and vendors who are well prepared to help you on this journey.

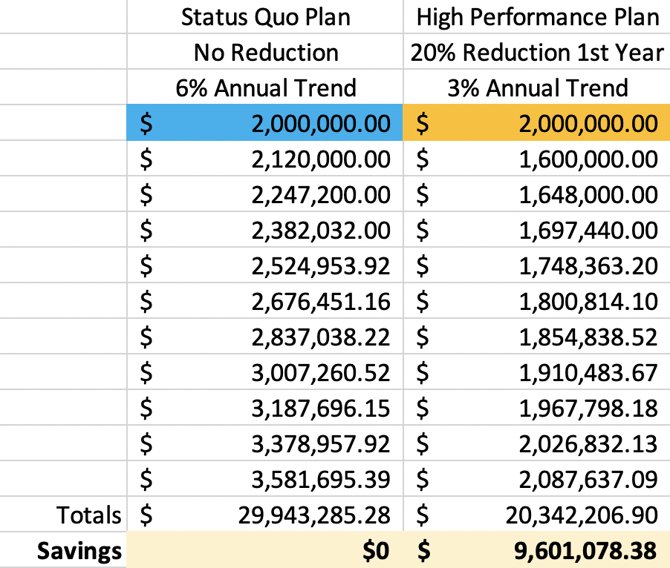

Still doubting yourself? A picture is worth a thousand words. Here are some numbers that apply to a company with 140 employees on their plan:

The simple question to ask is this.... is $9,601,078 worth the investment in time and energy to do things a little differently.

An investment in yourself, your organization and your employees.

I bet I know what employees would say.

Exhibit 2 Source: 2019 Annual Health Care Cost Trends Report